Money Fund Market is available for corporations and financial institutions (professional clients) who wish to manage their cash and liquidity more efficiently.

Money Fund Market is an independent, money market fund platform, designed to empower organisations by providing simplified access to institutional money market funds from international investment managers.

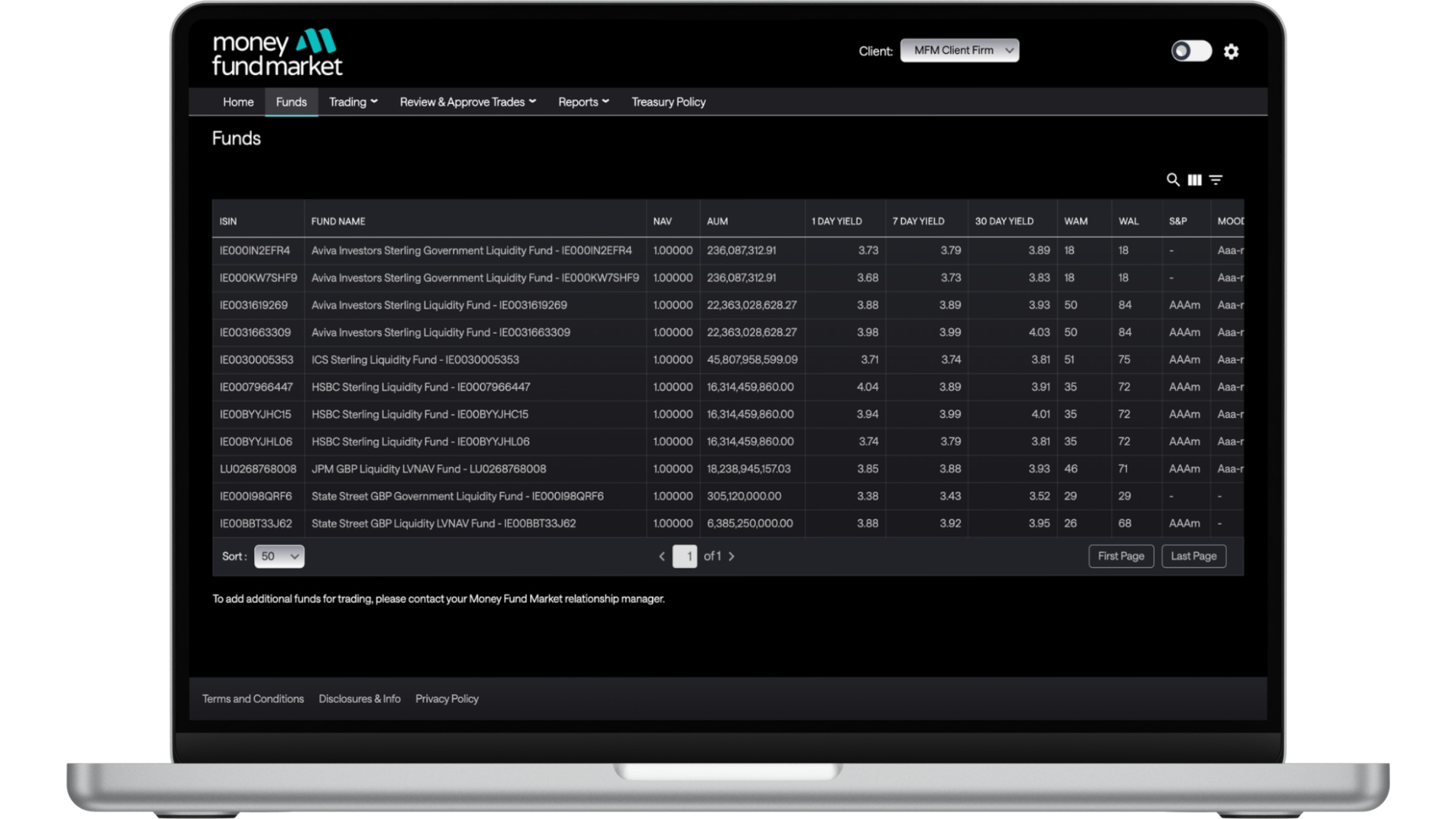

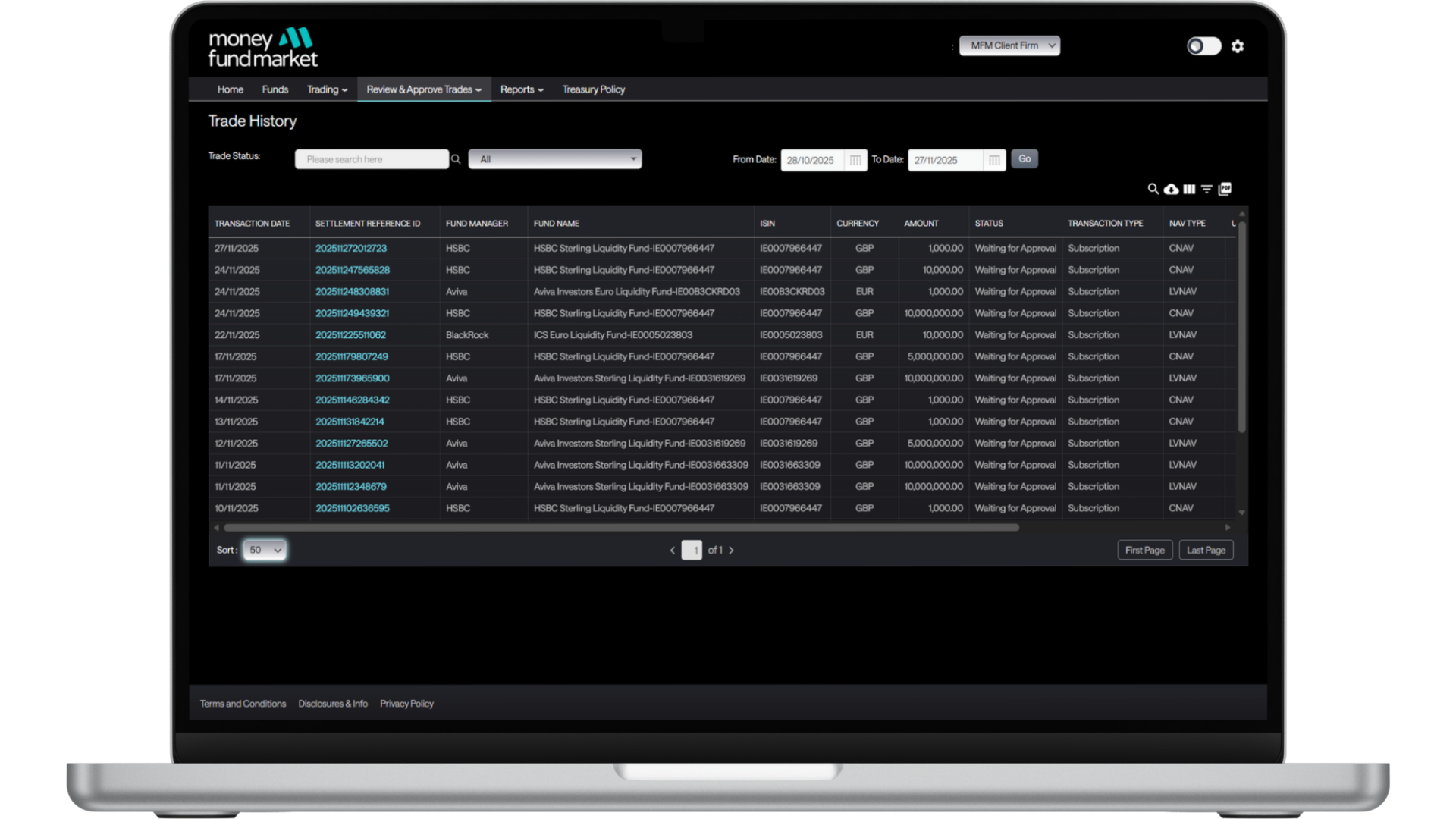

Access money market fund execution, settlement and risk management tools through a user-friendly dashboard. Money Fund Market delivers detailed risk analysis and reporting features via a streamlined account opening process.

Request a CallAccess a range of GBP, USD and EUR money market funds at competitive fees from the world's leading institutional investment managers.

Monitor cash balances, risk exposures and configure rules and restrictions to ensure compliance with investment guidelines and treasury policies.

Create instant, customised reports including detailed holdings, transactions and exposure breakdowns across your portfolio of investments.

Dedicated relationship management provided by treasury investment professionals who understand your business.

Money Fund Market is built for the evolving needs of treasurers, finance directors and CFOs, providing cutting-edge tools to navigate and manage every aspect of short-term money market fund investing.

We understand the challenges of modern treasury management and the importance of independence, choice and efficient access to liquidity solutions.

Simplify how you manage money market fund investments through a single, user-friendly dashboard with total control across your portfolio.

The Money Fund Market platform provides everything needed to enhance your treasury management and achieve capital preservation, liquidity and competitive returns through a streamlined investment process.

Access a universe of comprehensive fund and investment management data, detailed portfolio positioning and transaction analysis.

Monitor counterparty exposure, credit ratings, distributions, maturities, security types and geographies. Aggregate reporting across all fund holdings with integration into treasury management systems, ERP’s, banks and data providers.

Money Fund Market is available for corporations and financial institutions (professional clients) who wish to manage their cash and liquidity more efficiently.

A select number of KYC documents are required to open a facility. Your relationship manager will guide you through the requirements.

We aim to onboard clients within 48 hours of completing the relevant subscription document and KYC requirements.

No, once you have onboarded with Money Fund Market you will have access to the full suite of fund managers available on the platform.

You can invest in GBP, USD and EUR denominated money markets funds via the platform.

Clients can configure their investment guidelines and approval processes on the platform.

We conduct anti-money laundering checks on all clients as required by the relevant laws and regulations that apply.

Richmond Finance Ltd trading as Money Fund Market is an appointed representative of RiskSave Technologies Limited, which is authorised and regulated by the Financial Conduct Authority.

Client data, including personal and organisational information is securely stored and encrypted using industry standard encryption. Access to the Money Fund Market platform is secured using two-factor authentication.

There are no transaction or sign-up fees for using the platform. Money Fund Market is provided at zero cost to clients. Money Fund Market receives distribution fees from investment managers; additional details are provided in the customer agreement.

You can open a Money Fund Market account for a holding company as well as for trading companies.

Redemption instructions are processed immediately upon receipt. Most money market funds offer T+0 settlement, making funds available in your clearing account the same day, ready for withdrawal to your bank.